2025 Tax Brackets Married Jointly Single

Blog2025 Tax Brackets Married Jointly Single. Your bracket depends on your taxable income and filing status. Taxable income of up to $44,625.

The irs has unveiled its annual inflation adjustments for the. There are seven different income tax rates:

The filing status options are to file as single, married filing jointly, married filing separately, head of household, or qualified surviving spouse.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, The seven federal tax bracket rates range from 10% to 37% 2025 tax brackets and federal income tax. For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers.

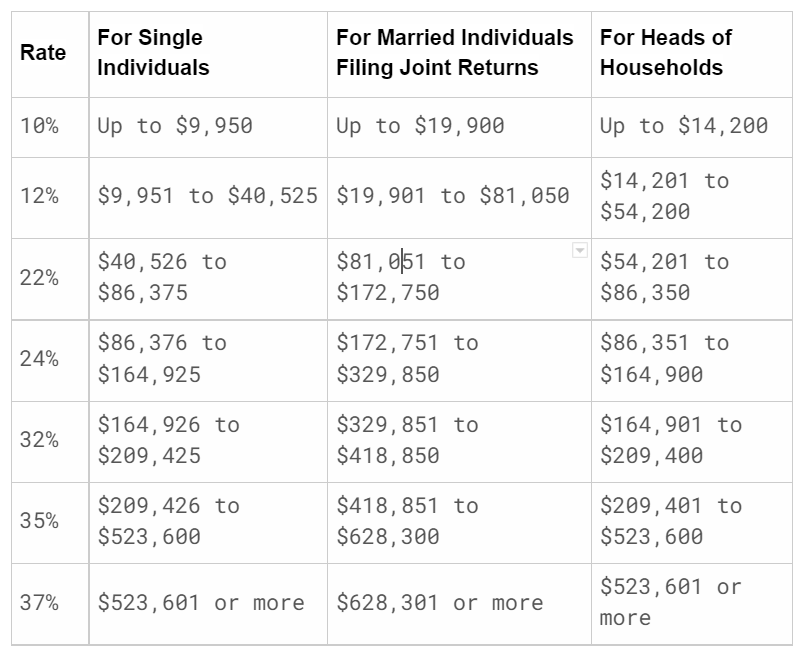

2025 Tax Brackets Married Jointly Single Cherye Juliann, Married couples who each file a separate tax return. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Tax brackets 2025 usa married jointly. 2025 income tax brackets by filing status:

Tax Brackets 2025 Married Jointly Chart Linea Petunia, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700).

Tax Brackets 2025 Irs Single Elana Harmony, In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200, then 12% on any additional income up to $94,300, 22% on any. Head of household income range:.

2025 California Tax Brackets Married Filing Jointly Amalea Blondell, There are seven federal tax brackets for tax year 2025. In 2025, the federal income tax rates consist of seven brackets:

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, Generally, these rates remain the same unless congress passes new tax legislation. Married couples who each file a separate tax return.

Tax Brackets For Married Filing Jointly 2025 Lyndy Roobbie, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the. Use tab to go to the next focusable element.

Tax brackets married filing jointly — Teletype, Heads of households who are unmarried but taking care. Tax brackets 2025 usa married jointly hedy ralina, for a single taxpayer, the rates are:

What Are The 2025 Tax Brackets For Married Couples Pammy Batsheva, The highest earners fall into the 37% range,. Use tab to go to the next focusable element.

For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying.